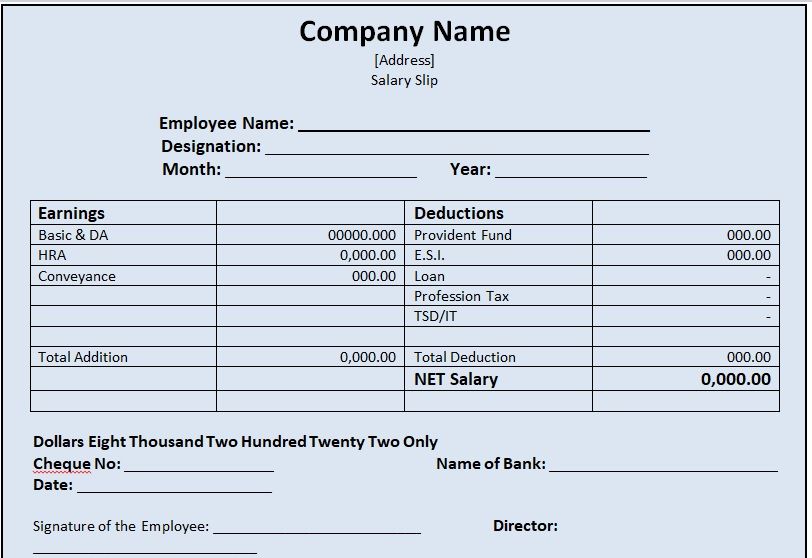

Important Formulas To Calculate Components of SalaryĬTC = Gross Salary + PF + Health InsuranceĪllowances = HRA + Medical + Conveyance + Travel Allowance + Special Allowanceĭeductions = Professional Tax + TDS (Tax Deducted At Source) + EPF Employee Contribution Thus, the calculations include provident fund and employee allowances which are mandatory by law. These salary calculations are prepared according to the Indian salary structure and laws of employment. This involves keeping records of overtime, leaves, medical, health insurance, EPF (employee provident fund), ESI (employee state insurance), etc.Īn Employee Salary sheet is a document that helps you process the salaries of multiple employees in few minutes and generates salary slips of all employees in just one click. Payroll departments manage payroll data of employees on a micro-level. What are the percentage of employee provident fund contribution for employee and employer?.

Collection of ContributionĪn employer is liable to pay his contribution in respect of every employee and deduct employees contribution from wages bill and shall pay these contributions at the above specified rates to the Corporation within 15 days of the last day of the Calendar month in which the contributions fall due. Employers will however contribute their own share in respect of these employees. ) is 0.75% of the wages and that of employer's is 3.25% of the wages paid/payable in respect of the employees in every wage period.Įmployees in receipt of a daily average wage upto Rs.176/- are exempted from payment of contribution. Currently, the employee's contribution rate (w.e.f. The contribution payable to the Corporation in respect of an employee shall comprise of employer's contribution and employee's contribution at a specified rate. Scheme being contributory in nature, all the employees in the factories or establishments to which the Act applies shall be insured in a manner provided by the Act.

0 kommentar(er)

0 kommentar(er)